40+ Mortgage calculator additional borrowing

Our calculator includes amoritization tables bi-weekly savings. How long the mortgage lasts will affect your monthly payments and the total.

Ssjtafrpq7xz M

You wont have to pay this amount back and it is designed to get you into a home quicker.

. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Important information assumptions. Our mortgage calculator gives you an idea of what you could borrow and shows the current interest rates.

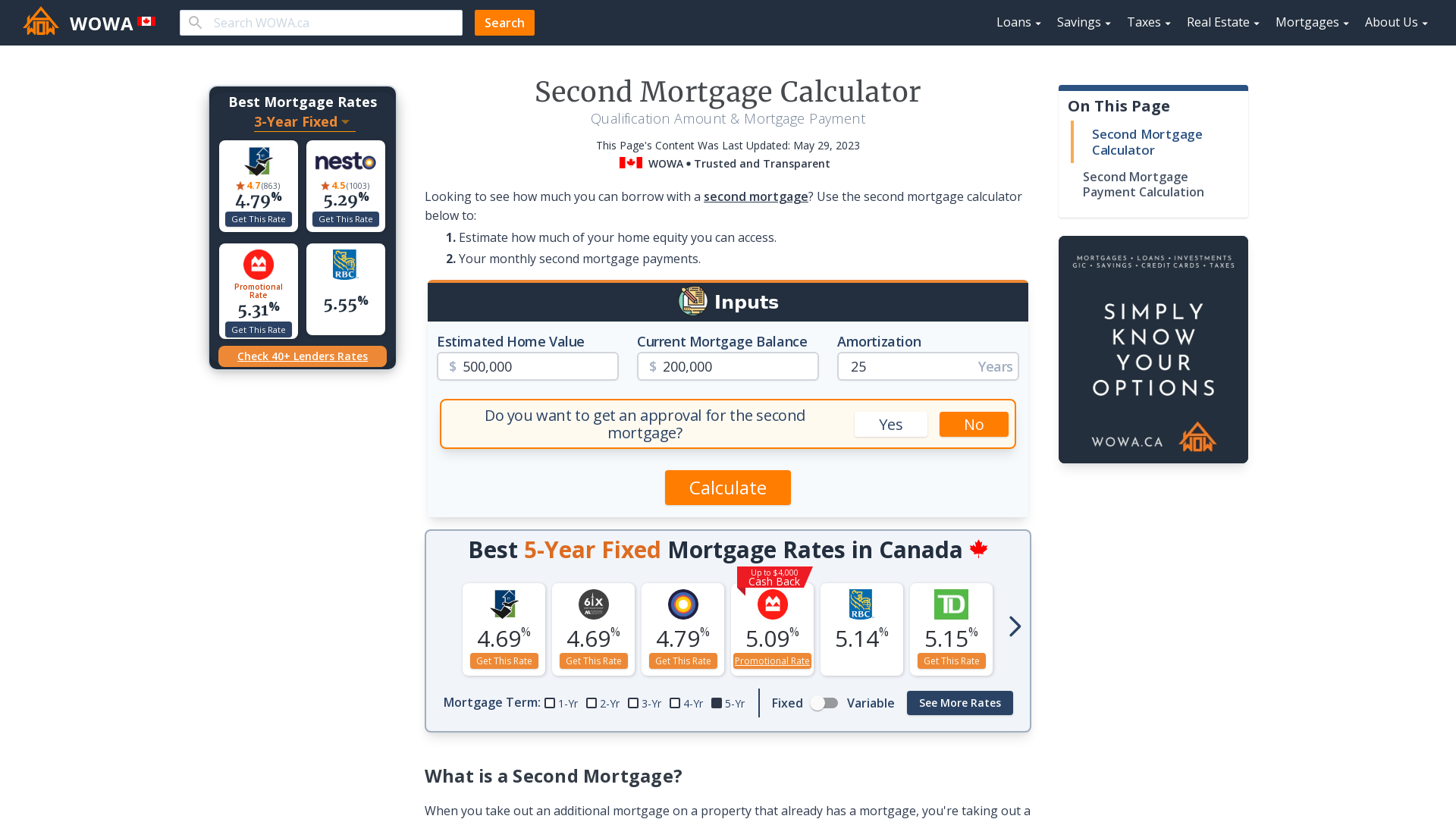

How much can I borrow. Our mortgage brokers are specialists in. How much can I borrow.

If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal. For additional information about or to do calculations involving mortgages or auto loans please visit the Mortgage Calculator or Auto Loan Calculator. To reduce your interest rate or increase your borrowing capacity.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Is there additional borrowing. 65 for incomes 60000 100000.

A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. This is the amount of the mortgage expressed as a percentage of the property value. What will it cost.

Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. 5 year fixed product. Based on borrowing at an interest rate of 5 for 25 years your monthly repayments would be.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. The figures shown in respect of both repayment and interest only mortgages do not include the cost of additional life cover. How much can I borrow calculator.

Five year fixed rate for existing customers of 300. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Try our Mortgage Repayment Calculator and see how much your monthly payments could cost with a market leading mortgage rate.

Most BTL loans are structured as interest-only. Loan-to-Value Ratio Qualifications. 40 of gross salary or wage for incomes less than 60000.

Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. The calculator doesnt factor in any charges for early repayments. Repayments are based on a three year fixed rate of 295 APRC 371.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. View how much you can borrow. Further advance payment calculator Find out how much more your client can borrow.

You can also compare monthly payments. Mortgage Calculator - How much could I borrow. While others may only count it at a reduced rate of 50.

A mortgage usually includes the following key components. We do not offer additional loans above a maximum LTV of 85 including your existing mortgage. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Mortgage terms - mortgage terms of up to 40 years are available. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE. You could then use this additional money to fund home improvements or a one-off purchase like a car or holiday for example.

The best rates are reserved for people borrowing at a lower loan to value ratio. After year three a Managed Variable Rate 80-90 LTV of 39 APRC 397 applies however there are also Fixed Rate options that would be available as an alternative to this Managed Variable Rate eg. Mortgages are how most people are able to own homes in the US.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. For example a 75 LTV mortgage on a property valued at 100000 would mean borrowing 75000. Additional borrowing applications will not be permitted within 6 months of completion of the original mortgage.

These are also the basic components of a mortgage. If 40 of your monthly payment is allocated to sub-account 1 with the remaining 60 allocated to sub-account 2 any overpayments will. Though it can range from 20 to 40.

Offset savings example calculation. Use the NatWest Mortgage Overpayment Calculator to find out whether you could repay your mortgage faster or pay less each month. Lets say you are 3 years into a 30-year 500000 home loan with a 100 offset account which you havent yet added any savings toYou have built up some money.

Mortgage calculator Mortgage repayment calculator Stamp duty calculator. Product Transfers and Additional Borrowing. Fixed Monthly Payment Amount This method helps determine the time required to pay off a loan and is often used to find how fast the debt on a credit card can be repaid.

With several primary inputs as well as additional advanced fields that account for PMI homeowners insurance zip codeproperty taxes and homeowner association fees Guaranteed Rates home mortgage calculator incorporates almost every conceivable variable that could affect your mortgage costsThe result is an estimate of future monthly. For those who are self-employed you must provide additional. Generally a lower LTV gives you access to more competitive rates and a more comprehensive range of lenders.

This program will give an additional 25 percent capped at 3000 to your home savings. Releasing equity will increase your loan-to-value LTV. The calculator assumes that the overpayments illustrated remain constant throughout the term of the mortgage and are made on a monthly basis if overpayments are made on an adhoc basis this will reduce the amount of interest paid but not the loan term.

If youre buying with a 40 deposit then youll qualify for much better rates than if youre buying with a 10 deposit. This is an additional payment made on top of your usual monthly payment. Check out the webs best free mortgage calculator to save money on your home loan today.

So if you had built up 60 equity in your home a position of 40 LTV you.

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

Second Mortgage Calculator Qualification Payment Wowa Ca

Private Mortgage Calculator 2022 Wowa Ca

How To Use A Mortgage Calculator Comparewise

How To Get A Mortgage With Bad Credit Comparewise

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

10 Best Instant Payday Loans With No Credit Check Get Online Cash Advance For Bad Credit 2022

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

The Ignorance Of People 40 Today You Can T Even Have A Conversation Without Them Gaslighting You Into Thinking The Market Is Affordable For Young People R Canadahousing

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Mortgage Refinance Guide Procedure Costs Calculator Wowa Ca

Simple Loan Application Form Template Beautiful Personal Loans Calculator India Quick And Easy Cash Contract Template Letter Templates Personal Loans

Smarter Loans Review 2022 Comparewise

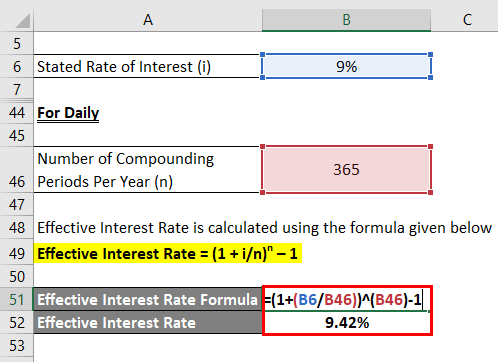

Effective Interest Rate Formula Calculator With Excel Template

Yen Mortgage Loan Calculator How Much Can You Afford To Buy In Japan Blog

Jsqnt Gqgxdjfm

Heloc Calculator Calculate Available Home Equity Wowa Ca